The price of cocoa

In this article, Mathis DIALLO (ESSEC Business School, Grande Ecole Program – Master in Management, 2023-2026) explains why the price of cocoa may vary so much.

For a long time, the price of cocoa and the fluctuation of its price within the financial markets has been the result of a combination of factors, such as weather conditions (whether favourable or unfavourable), diseases affecting crops (they are not always present, may re-emerge at certain times), etc.

This situation has always raised concerns about the future viability of the cocoa industry and highlights the importance of sustainability and resilience in the global chocolate supply chain.

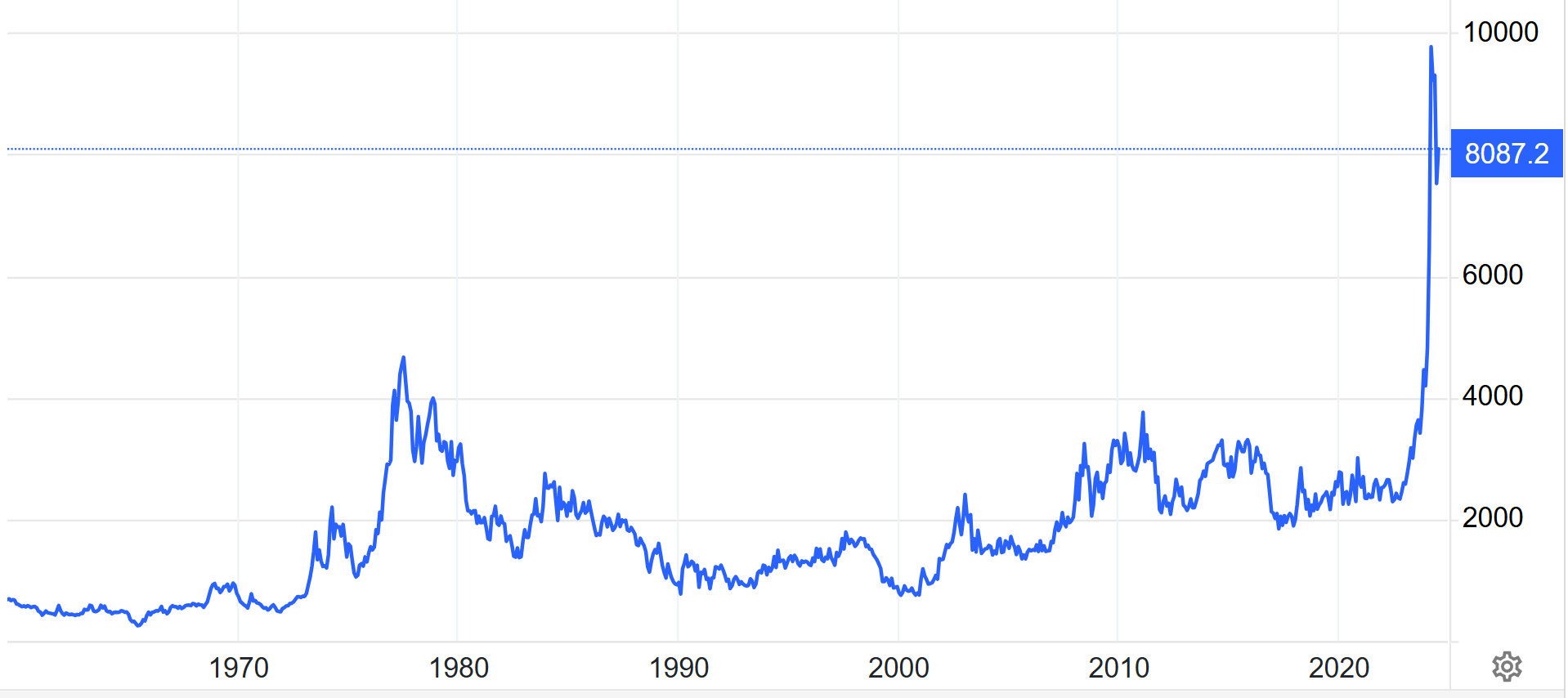

Evolution of cocoa price.

Source: Trading Economics.

Evolution of the cocoa market price : the drivers of the supply and demand for cocoa

Let’s start with the weather:

The major cocoa-producing regions, such as Côte d’Ivoire and Ghana, are confronted with often unpredictable weather conditions, including droughts and climatic accidents. It is clear that these phenomena can contribute to a reduction in production and therefore to a drop in supply on the world market.

In addition to difficult weather conditions, cocoa crops are also affected by diseases such as the swollen shoot virus. These diseases weaken crops and further reduce the production of cocoa beans for processing.

It’s important to remember that the world’s cocoa production is heavily concentrated in West Africa, particularly Côte d’Ivoire and Ghana. The slightest problem affecting these regions will have a real effect on world cocoa supply and therefore on market price volatility.

The role of speculation

Speculative funds can sometimes fuel price rises, with the latest financial crisis prompting hedge funds to position themselves on the commodities markets. The cocoa side of the NYSE or City is even more susceptible to speculation. Whether there is a shortage or a surplus, speculation is based on the actual causes of the physical market, but exaggerates the trends. In 2017, an overproduction of just 200,000 tonnes caused a 30% fall in the market price, leading to a speculative spiral. Today, the rise in speculation is at the root of this all-time record for cocoa prices. In recent months, financial operators have invested a record 8.7 billion dollars on the New York and London stock exchanges to speculate on a rise in cocoa prices.

So hedge funds are not directly responsible for the increase. They are based primarily on actual causes. Despite their massive injections of liquidity, the market no longer reflects the physical realities of cocoa.

Recent market development (2023-2024)

Figure 2 represents the evolution of the price of cocoa from 2023 to 2024 (USD/T).

Figure 2. Evolution of cocoa price (1923-2024).

Source: Trading Economics.

Background: The last record price was set in 1977 at $5,300 per tonne. It was broken in February 2024. Barely two months later, and defying all projections, the price of cocoa doubled to $10,600 per tonne on 15 April 2024. The following week, it reached $11,479. In one year, the price of cocoa has risen by 268%.

Explanation:

With Easter approaching, a time of year when people consume much more chocolate than usual (buying chocolate eggs), the price of cocoa is hitting record highs on the international market. The price of cocoa has just passed the 6,000 dollars a tonne mark, a rise unprecedented since 1977.

Worse still, on 27 March 2024, the price of a tonne of cocoa exceeded 10,000 dollars a tonne. This was unprecedented for the raw material of chocolate, to the point where Bloomberg noted that the cocoa bean was overtaking Nvidia at that point.

This is the third year in a row that the market has been in deficit, with harvests in West Africa down due to the vagaries of the weather, strong demand and speculation.

The gap between supply and demand is expected to rise to around 430,000 tonnes of cocoa in 2024 (around 8% of normal world production). It is therefore impossible for there to be enough for everyone at the end of the year, and some populations are likely to experience shortages of this product.

But a few weeks later, the price of cocoa ended up declining, and not without reason: 1) renewed rainfall in Nigeria led to a significant increase in production; 2) the Intercontinental Exchange (the main cocoa market) raised the margin on contracts, making it more difficult to find buyers or sellers on the market.

Recent events have largely confirmed the volatility of this type of product on the international financial markets, which is far too dependent on environmental hazards, the number of players on the market and financial market speculation.

Why should I be interested in this post?

It shows how much volatile may the market of raw materials be and enables us to understand better about the fluctuations of price of cocoa.

Related posts

▶ Mathis DIALLO The environmental impact of cocoa

▶ Mathis DIALLO The cocoa production

▶ Mathis DIALLO Different types of chocolate

▶ Mathis DIALLO The Armarajo hedge fund’s corner in the cocoa market in 2010

Useful resources

Trading Economics Cocoa

International Cocoa Organization (ICCO) Cocoa Market Report for March 2024

World Wide Chocolate Cocoa Cost Soars to Historic High – Why is Cocoa’s Cost Rising? | April 20244

About the author

The article was written in July 2024 by Mathis DIALLO (ESSEC Business School, Grande Ecole Program – Master in Management, 2023-2026).