Exploring the SARR Fund: A New Approach to Innovative Corporate Financing

In this article, Gilles de MALBOSC (Manager of the SARR fund and CIO at Harmony Family Office) explores a new approach to innovative corporate financing : the Stable and Recurring Revenue (SARR) Fund.

Exploring the SARR Fund: A New Approach to Innovative Financing

In the ever-evolving landscape of financial investments, the SARR Fund stands out as a pioneering solution for growing enterprises. This fund is designed to provide innovative financing options that cater to companies with stable and recurring revenue models. Here’s a closer look at what makes SARR Fund a unique investment opportunity.

Introduction to SARR Fund

SARR stands for Stable and Recurring Revenue. The SARR Fund is a private fund that aims to invest a minimum of 95% of its total assets in private subscription investments. Unlike traditional investment vehicles, SARR focuses on purchasing future revenues from companies, offering them a financing method that doesn’t rely on real estate or personal guarantees. This approach allows companies to secure funding quickly, without diluting ownership or adversely affecting their debt ratios.

Why SARR Fund?

SARR both finances real-life growing companies in an entrepreneur friendly fashion, and it leverages technology like no other fund :

Innovative Financing Solutions

SARR helps entrepreneurs.

- Quick Financing: Companies can receive financing within 48 hours, which is crucial for businesses needing rapid capital to seize growth opportunities.

- Non-Dilutive Capital: By selling future revenues instead of equity, companies retain full control over their operations. For entrepreneurs, it’s like being granted some debt, in 48 hours, and without impacting their debt-ratio

- Data-Driven Decisions: Financing decisions are based purely on data, ensuring fairness and transparency regardless of the entrepreneur’s background. Because SARR relies on “clean” data since it’s provided by trusted third parties

Timing and Technology

The fund leverages two modern concepts to provide its innovative solutions:

- Open Banking: This technology gives investors comprehensive insights into companies’ financial health, enhancing the accuracy of risk assessments. This allows them to make decisions based on data that comes directly from 3 trusted third parties: the bank, the accountant and the subscription manager

- XaaS Model: Companies operating on a subscription-based model offer predictable and stable revenue streams, making them ideal candidates for the fund.

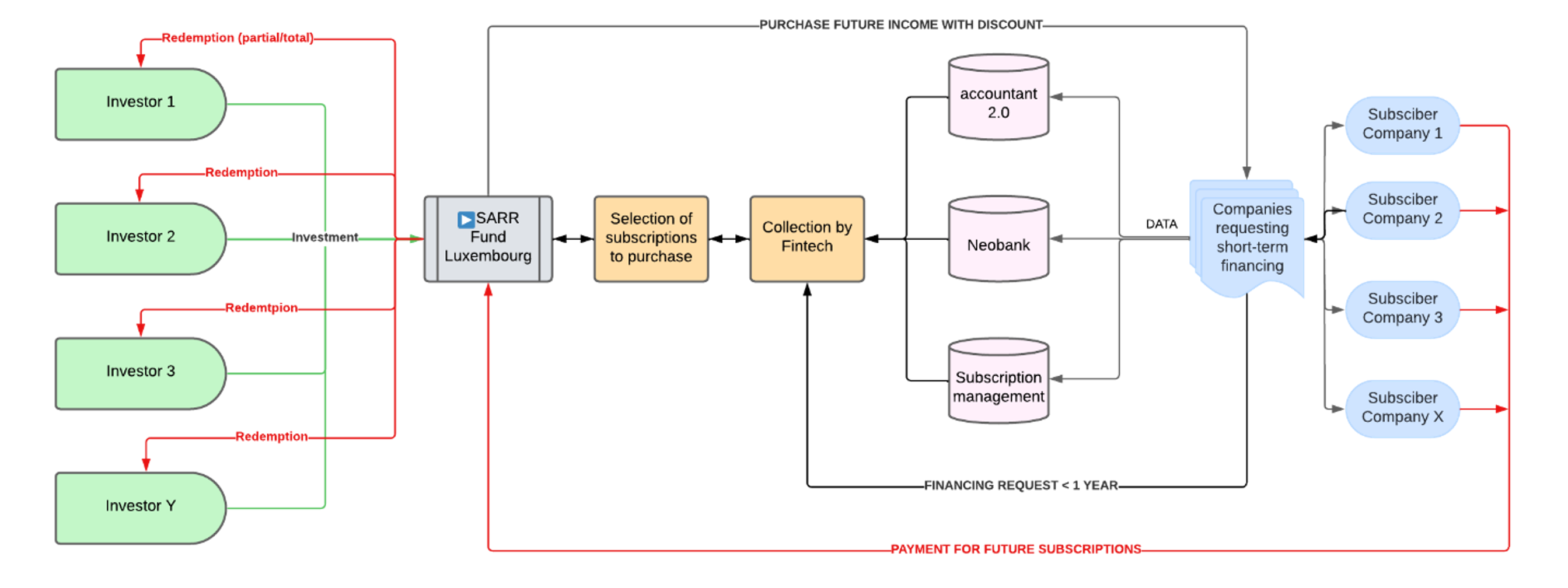

How Does SARR Fund Work?

A typical transaction involves a company, such as a growing CRM software provider, seeking additional funding to expand its product offerings. The step-by-step process is described below:

- Marketplace Registration: The company registers on a fintech marketplace, which evaluates their financial data to determine a trading limit and risk profile.

- Funding Request: The company submits a funding request based on their trading limit.

- Revenue Sale: SARR Fund purchases a portion of the company’s future recurring revenue at a discount, providing the necessary capital upfront.

- Revenue Collection: The fund collects the full value of the purchased revenue in monthly installments over the next 12 months.

Process of a transaction.

Source: The company.

Benefits for Investors

Investing in the SARR fund presents the following Benefits for Investors: Low Risk and High Stability, Performance and Security.

Low Risk and High Stability

- Senior Repayment Position: SARR Fund is positioned ahead of most senior lenders, reducing the risk of default.

- Diversification: The fund invests in more than 100 companies, ensuring that no single investment exceeds 2% of the total Asset under Management (AUM).

- Monthly Liquidity: Investors have access to 7.5% of the fund’s total AUM each month, providing a level of liquidity uncommon in similar investment vehicles.

Performance and Security

- Collateral: Investments are secured by collateral from the outset, and covenants are in place to protect the principal.

- Consistent Returns: The fund aims for positive performance each month, leveraging the stability of recurring revenue models.

Target Audience

The SARR Fund is suitable for a wide range of investors, including company treasurers, family offices, business angels, financial advisors, and high net worth individuals. Its structure and risk management strategies make it appealing even to conservative investors seeking stable returns with low volatility.

Conclusion

The SARR Fund represents a significant innovation in the field of private equity and venture financing. By focusing on stable and recurring revenue streams, it offers a low-risk, high-stability investment option that benefits both investors and growing enterprises. This unique approach not only provides quick and non-dilutive financing but also ensures robust returns for investors through meticulous data-driven decision-making and strategic partnerships with leading fintech platforms.

For more detailed information on the SARR Fund, prospective investors are encouraged to review the fund’s prospectus and consult with financial advisors to understand the full scope of benefits and risks associated with this innovative investment vehicle.

Useful resources

The Future of Data-Driven Finance and RegTech: Lessons from EU Big Bang II European Banking Institute Working Paper Series 2019/35

From FinTech to TechFin: The Regulatory Challenges of Data-Driven Finance

New York University Journal of Law and Business, Forthcoming European Banking Institute Working Paper Series 2017 – No. 6

Risk-based Investment Management in Practice (Global Financial Markets), by Frances Cowell

Banks and the real economy: An assessment of the research, Allen N. Berger, Phil Molyneux, John O.S. Wilson

About the author

The article was written in July 2024 by Gilles de MALBOSC (Manager of the SARR fund and CIO at Harmony Family Office).