New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

Send an order and impact the market!

Send an order and impact the market!

The Send an order simulation helps you to get started with financial markets. As a SimTrader, your goal in this simulation is to send your first order to the market and to see how the market is impacted by your order. At the start of the simulation, you own an account worth €10,000 in cash and 1,000 BestPizza shares. The Send an order simulation will be the opportunity to discover the mechanisms of a financial market: the limit order book, market orders ("MKT" orders) and limit orders ("LMT" orders). The duration of the simulation is initially set to five minutes, which corresponds to a 24-hour trading day. Using the timeline of the simulation, you can increase or decrease the simulation speed at any time. |

Your grade for this simulation (100 points) takes into account the following elements:

If you launch the simulation several times, the simulation grade retained is the best grade you obtained on all the simulations (grade which takes into account your trading performance, your trading activity and your MCQ test for each simulation). |

BestPizza is a restaurant chain in France, which has been doing business since the 1960s. Building on its strong reputation, the chain has more than 100 restaurants spread in the Paris area and other regions. The development of the company took place gradually even though the recurrence of economic crises had a negative impact on the number of customers. BestPizza was initially founded by two Italian partners and was introduced on the stock market in the early 2000s. |  |

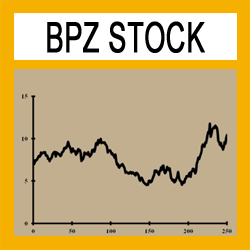

The ticker symbol for BestPizza shares traded on the market is BPZ. The BPZ stock price has stayed around the same level as its introductory price of €10 in 2000. If the stock price hasn't increased, it is worth noting that the BestPizza company has continuously distributed dividends to its shareholders. Over the recent period, the stock price has fluctuated around €10 depending on the bad news and the good news about the company, the food service sector and the economy. |  |

Today, the stock price of BestPizza should evolve according to the news flow, and the supply and demand for the shares. |

The Send an order simulation focuses on the basics of the market: the limit order book and how to send orders to the market. Teaching goals: the Send an order simulation will be the opportunity to understand a market with buyers and sellers, and the supply and demand. How the market will react to your orders? Learning objectives: this simulation will help to learn the following elements of trading:

Before or after launching this simulation, you can learn more about financial markets by taking related courses to the simulation. Download the case note to help you during the simulation. |

|

Professor François Longin « You're just a click away from sending your first order to the market. » |