New on SimTrade?

Register for free and join the SimTrade community.

By connecting to this website you accept Terms of use.

Experience market inefficiency!

Experience market inefficiency!

At the start of the simulation, you own an account worth €100,000 in cash and 1,000 Blé de France shares. As a SimTrader, your goal in this simulation is to maximize your trading gains. In this simulation, you can send all types of orders to the market: market orders (MKT), limit orders (LMT), best limit orders (BL), stop orders (STP) and stop limit orders (STL). The duration of the simulation is initially set to 10 minutes, which corresponds to a 24-hour trading day. Using the timeline, you can increase or decrease the simulation speed at any time. |

Your grade for this simulation (100 points) takes into account the following elements:

|

Blé de France is a French wheat producer. The firm was created in 1780 by the Turgot de la Beauce brothers, nephews of the famous financial controller of the King of France Louis XVI. The firm is still managed by a descendant of the founders, Charles-Louis Turgot de la Beauce, who is an emblem of the cereal industry in France. Blé de France fields are mainly located in the Beauce area in the center of France. The sales structure is composed of two parts:

|

|

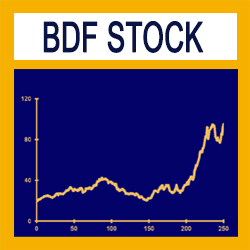

The ticker symbol for Blé de France shares traded on the market is BDF. Blé de France was introduced in the French stock market in the 1970s. During the past few years, its stock price soared. This strong price increase can be partly explained by the strong increase in the wheat prices at the world level. Over the recent period, the BDF stock price has fluctuated around €120. The market price has evolved according to the news flow about the company and the wheat market. |

|

Today should be a day rich in events for the company Blé de France. In particular, at 2 pm, CEO Charles-Louis Turgot de la Beauce participates to a meeting with financial analysts. He will announce the profit of the company for the last quarter. The market consensus is €120 million for Blé de France profit.

Like other companies in the sector, Blé de France faces three risks for its business:

These three risks are largely influenced by the weather, both in France for the first two risks (quantity and quality of the harvest) and globally for the third risk (wheat price on the international market).

What is the firm going to announce? How will the market react to the news? Will the market be efficient or inefficient in processing information? And especially how will you react? Those are the questions... |

The simulation Inefficient market deals with the firm valuation. How is a firm valued? How is the value of the firm reflected into the stock price? This simulation looks at a key concept in finance: earnings per share. Teaching goals: the simulation Inefficient market will be the opportunity to understand deeper how a market with a limit order book works. How do buyers and sellers meet to trade with each other? What is the supply and demand in such a market? How is the limit order book impacted by a new order? How does the limit order book evolve over time? How does a transaction happen? How are prices determined in such a market? How does the market react to your orders? How to combine all types of orders? Learning objectives: this simulation will help you to learn the following elements of finance:

Before or after launching this simulation, you can learn more on information in financial markets by taking related courses to the simulation. Download the case note to help you during the simulation. |

|

Gabriel Eschbach « The key is knowing how to process information. The market is anticipating what will happen, but things never happen as expected. The market reacts to the rumor and adjusts to the new. And you! What do you expect? How will you react? What are you going to do? » |

|

Professor François Longin « Before starting the simulation, remember that the market is always right; and that the market is always right even when it is wrong... » |